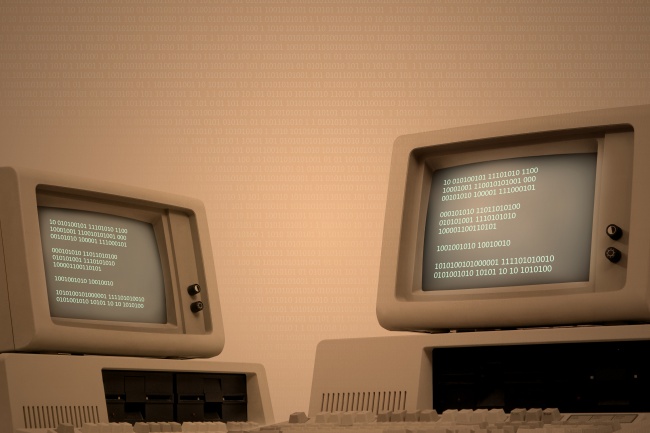

Getting Your Business Ready for Digital Transformations

If you follow technology news, you may get the impression that new advances in Blockchain, Internet of Things, Artificial Intelligence, Virtual Reality and other innovative areas come up every other day. Moreover, certain companies try to adopt these technologies in order to make some income or reduce operating expenses. However, financial area is not that successful in implementing these innovations.

Many firms in the financial industry are used to store their data in a number of disparate places. For this reason, transforming the financial system in the direction of its digitalization can require a lot of time and effort. Although banks, insurance and investment companies are gradually moving towards increasing a great deal of their services online, we cannot talk about a steady trend as of yet.

Major Problem: Security

There is, however, one consistent pattern, which can be observed within any industry – the strive for security and the desire to protect data via all possible means. Taking into account recent high-profile cases of data leakage, companies are becoming even more concerned. As a result we can witness a range of new, quite strict security and privacy regulations, which are triggered both by external and internal forces.

A good example of external forces triggering changes in privacy regulation policies is General Data Protection Regulation (GDPR) – a set of rules released by the European Commission, which determines the process of doing business with the EU citizens in terms of data protection. From the moment of its implementation, May 25, 2018, all companies, which offer their goods and services to the EU citizens, are obliged to reconsider their privacy regulation policies according to the GDPR (most probably, in the direction of tightening the security measures) irrespective to their own desire to do so.

Internal security measures in terms of data protection are also getting more severe. Many companies within financial industry are considering blockchain technology as an up-to-date alternative of conventional means for information transportation in order to protect themselves from data leakage. However, still these technologies in financial field are rather at an experimental trial stage, more so than a stable tendency.

Facing Challenges

Implementation of new technologies means new challenges for organisations. The financial sector is only in the beginning of its paths towards adopting such things as mobile biometrics, smartphone cameras and geolocation. By combining these aspects with advanced analytics, firms can speed up and improve many of their processes (e.g. increase revenue or simplify the process of communication with customers).

Unfortunately, the majority of such organizations are in no hurry to apply these solutions due to severe overload by day-to-day tasks. However, if you are interested in optimization of your processes, contact us. We can offer the best solution.